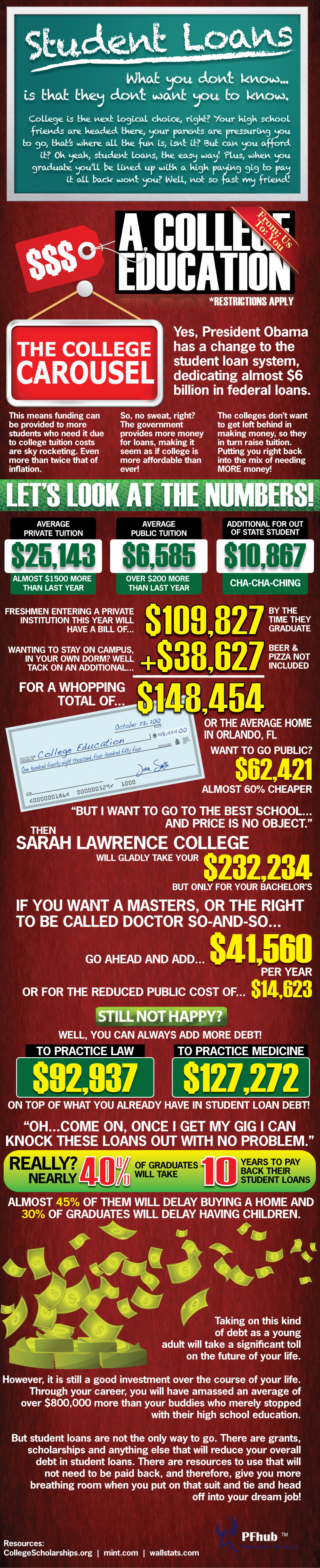

Your parents have always told you an education is the be-all and end-all. What they didn’t tell you is that the average college student will owe $148,454.00 dollars when they graduate and it will take about 10 years to pay that back!

Like This? Share It!

Click the Image Below to Make it Bigger

Student Loans

What you don’t know is that they don’t want you to know. College is the next logical choice, right? Your high school friends are headed there, your parents are pressuring you to go, that’s where all the fun is, isn’t it?

But can you afford it?

Oh yeah, student loans, the easy way. Plus, when you graduate you’ll be lined up with a high paying gig to pay it all back won’t you? Well, not so fast my friend!

The College Carousel

Yes, President Obama has a change to the student loan system, dedicating almost $6 billion in federal loans.

This means funding can be provided to more students who need it due to college tuition costs are sky rocketing. Even more than twice that of inflation. So, no sweat, right? The government provides more money for loans, making it seem as if college is more affordable than ever.

The colleges don’t want to get left behind in making money, so they in turn raise tuition. Putting you right back into the mix of needing MORE money.

- Average Private Tuition: $25,143.00 which is almost $1500.00 more than last year.

- Average Public Tuition: $6,585 which is over $200.00 more than last year.

- Additional Cost For Out of State Tuition: $10,867.00 well not much I can say here except, damn!

The Break Down

Freshmen entering a private institution this year can expect to pay around $109,827.00 in tuition by the time they graduate. But let’s not forget about the cost of staying in a dorm on campus which will set you back about $38,627.00.

So you can expect to owe approximately $148,454.00 by the time you graduate. Keep in mind this is for you average ranked college and if you really want to impress your parents tell then Sarah Lawrence College is for you at $232,234.00 for your bachelors.

Maybe law or medicine has caught your interest? If so be prepared to tack on an additional $92,937 and $127,272 respectively.

The Pay Off

These numbers may seem big but your going to be making the big bucks when you graduate, right?

Well that’s not exactly what statistics show. It will take 40% of the students who graduate from college 10 years to payback their student loans. This is turn will cause 45% of those students to delay purchasing a home and 30% of them will delay having children.

I believe the term “Snowball Effect” applies here.

Taking on this kind of debt as a young adult will take a significant toll on the future of your life. However, it is still a good investment over the course of your life.

Through your career, you will have amassed an average of over $800,000 more than your buddies who merely stopped with their high school education. But student loans are not the only way to go. There are grants, scholarships and anything else that will reduce your overall debt in student loans.

There are resources to use that will not need to be paid back, and therefore, give you more breathing room when you put on that suit and tie and head off into your dream job.