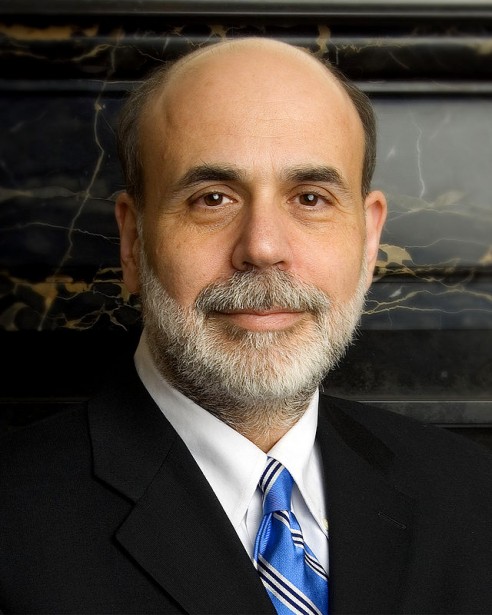

A somewhat frustrated Ben Bernanke appeared in court Thursday to testify regarding the United States government’s 2008 bailout of American International Group (AIG). Maurice R. Greenberg, AIG’s former chief executive, is suing the government, alleging that the terms of the 2008 bailout, which began at $85 billion and soared to $185 billion, were too callous.

Responding in simple, one- or two-word terms like “yes, sir” and “no, sir,” the former Federal Reserve Chair highlighted that the U.S. financial system was on the cusp of collapse, and the end of AIG would have spelled doom for the overall financial system.

Bernanke took exception to the suggestion that AIG received a raw deal from the U.S. central bank or it could have received a better deal elsewhere. The ex-Fed Chair purported that the AIG board overwhelmingly approved of the Fed’s offer and approved of the government’s terms and loan.

What turned heads throughout Bernanke’s testimony was his failure to recollect details of agreements or his lack of knowledge on certain matters.

For instance, when asked if he knew the basis for the interest AIG was being charged, Bernanke answered that he did not recall. When asked if he knew for certain if AIG’s loan was fully secured, he noted that it met the satisfaction of the Fed Bank of New York. Also, when inquired if he remembered when he first discovered that the agreement would consist of a controlling equity stake, Bernanke replied he did not.

The former head of one of the most powerful independent organizations in the world is expected to testify Friday. Also scheduled to testify this week were two other players from the financial meltdown in 2008: former Treasury Secretaries Henry Paulson and Timothy Geithner.

In trial testimony, Geithner defended the terms of the AIG bailout. He explained that the Fed and the Treasury Department were in agreement that AIG’s terrible financial situation was the result of its management taking on risky mortgage securities.