United States President Barack Obama spoke with CNBC on Thursday to discuss the issue of “fairness” in the economy. Most of the interview consisted of the president talking about “inversions,” a practice of U.S. companies merging with smaller overseas corporations to avoid paying taxes in the U.S.

Citing about nine inversions taking place this year, the Obama administration and leading Democrats are attempting to make the rules stricter. The president presented the case that corporations succeed because they had the benefits of some of the greatest universities in the world and a top-notch infrastructure.

Although it is legal what corporations are doing, President Obama conceded they are taking advantage of technicalities and “gaming the system” and refusing to do the right thing for their country and the American people.

“There are a whole range of benefits that have helped to build companies, create value, create profits,” Obama said. “For you to continue to benefit from that entire architecture that helps you thrive, but move your technical address simply to avoid paying taxes is neither fair nor is it something that’s going to be good for the country over the long term.”

“There are a whole range of benefits that have helped to build companies, create value, create profits,” Obama said. “For you to continue to benefit from that entire architecture that helps you thrive, but move your technical address simply to avoid paying taxes is neither fair nor is it something that’s going to be good for the country over the long term.”

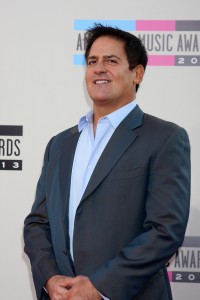

One day later, industry professionals and investors are responding to the president, including billionaire investor Mark Cuban, who believes taxes will eventually start to climb once more and more U.S. companies ditch the Land of the Free for overseas tax advantages. The lost revenues will have to be made up somewhere, says Cuban, though the U.S. government generates nearly $3 trillion a year.

“If this is part of a movement where in aggregate it really has a material impact on taxes paid, then again taxes are going to go up,” the owner of the Dallas Mavericks told CNBC on Friday.

“The cost of doing business … not the actual tax rate we pay … particularly for companies, individuals, entrepreneurs are easier to change and have a far greater impact on our net worth than all the ramifications and ruminations that the government can try to do to fix the tax code.”

Cuban further stated that if he had the option of receiving a 10 percent corporate tax or a significant reduction in administrative, bureaucratic red tape then he would select the ladder. The “Shark Tank” co-host averred that he could save a lot of money and time if the regulations weren’t as enormous as they are today.

Cuban also went to Twitter to air his frustrations with corporate inversions. He sent out a barrage of tweets Friday morning:

“If I own stock in your company and you move offshore for tax reasons I’m selling your stock. There are enough investment choices here.”

If I own stock in your company and you move offshore for tax reasons I'm selling your stock. There are enough investment choices here

— Mark Cuban (@mcuban) July 25, 2014

“If you talk to me as a shareholder and ask me to accept a higher PE so you can save jobs I’m open to it. The risk doesn’t leave the system.”

If you talk to me as a shareholder and ask me to accept a higher PE so you can save jobs I'm open to it. The risk doesn't leave the system

— Mark Cuban (@mcuban) July 25, 2014

“When companies move off shore to save on taxes, you and I make up the tax shortfall elsewhere sell those stocks and they won’t move.”

When companies move off shore to save on taxes, you and I make up the tax shortfall elsewhere sell those stocks and they won't move

— Mark Cuban (@mcuban) July 25, 2014