Having looked at a number of different mutual funds that focus in on generating returns based on the performance of specific market aspects, I’ve decided to spend this week comparing a set of broad market funds. By including funds such as the Janus Investment Fund Mid-Cap Value Fund, and the Fidelity New Millennium Fund, we can begin to see how value investing can be implemented as a broad market strategy.

Having looked at a number of different mutual funds that focus in on generating returns based on the performance of specific market aspects, I’ve decided to spend this week comparing a set of broad market funds. By including funds such as the Janus Investment Fund Mid-Cap Value Fund, and the Fidelity New Millennium Fund, we can begin to see how value investing can be implemented as a broad market strategy.

Both of these funds focus on generating capital gains from value-driven investment strategies, while still maintaining a focus on maintaining full diversification within the portfolio. Realistically, these funds can act as a fantastic back-bone to any personal portfolio.

Their combination of breadth and sophisticated evaluation can provide investors with a well calculated diversified exposure to the greater market, so that they can focus in on the aspects of investing that either interests them most, or for which they personally are most suited to personally handle.

If nothing else, these funds provide the peach of mind that your portfolio needs to keep you from stressing out over your finances. In this first article, I’ll provide a side-by-side overview of the funds, which can be used as a reference for the evaluative section that will be presented in the next posting.

Name: Janus Investment Fund: Perkins Mid Cap Value Fund; Class T Shares

Symbol: JMCVX

NAV: $21.71

Name: Fidelity MT Vernon Street Trust: Fidelity New Millennium Fund

Symbol: FMILX

NAV: $29.93

Objective & Strategy

- JMCVX: Janus Investments invests in this fund in order to pursue capital appreciation. This is achieved by investing in mid-sized companies that are currently trading at a discount. The value of the acquisition itself is valued as being within the range of the Russel Midcap Value index. This is a value-based fund.

- FMILX Fidelity pursues capital appreciation by identifying future beneficiaries of social and economic change. This is achieved by examining social attitudes, legislative actions, economic plans, product innovations, demographic shifts, and other trends to identify what is shaping the market place.

Comparative Performance

Average Annual Returns: JMCVX

1yr: -3.81%

3yr: 4.91%

5yr: 2.2%

10yr: 7.62%

Average Annual Returns: FMILX

1yr: 4.57%

3yr: 7.18%

5yr: 3.48%

10yr: 5.45%

Distributions

Fund: JMCVX

2007: $3.12

2008: $0.98

2009: $0.1

2010: $0.16

Fund: FMILX

2007: $4.39

2008: $0.19

2009: $0.11

2010: $0.16

Capital Requirements & Fees

Fund: JMCVX

MER: 0.99%

Front End Load: 0

Back End Load: 0

Min Investment: $2,500

Fund: FMILX

MER: 1.04%

Front End Load: 0

Back End Load: 0

Min Investment: $2,500

Risk Metrics

Fund: JMCVX

SD (fund): 17.42

SD (cat): 18.64

Beta: 0.9

Alpha: 0.15

R-SQ: 95

Best 3mo: 26.01%

Worst 3mo: -28.63%

Fund: FMILX

SD (fund): 20.23

SD (cat): 18.64

Beta: 1.04

Alpha: 0.43

R-SQ: 93

Best 3mo: 33%

Worst 3mo: -33.24%

Holdings

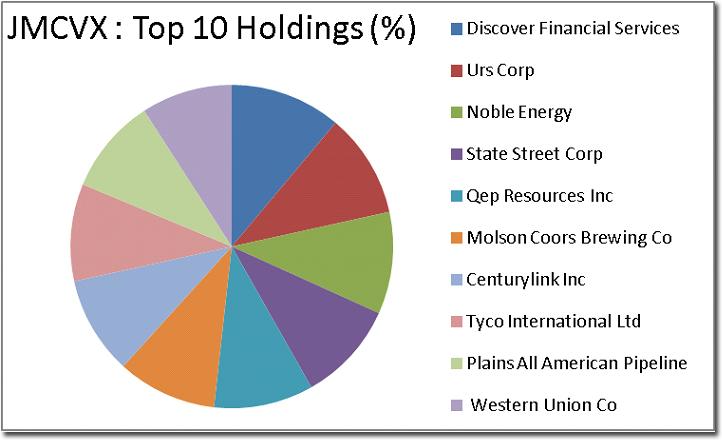

Fund: JMCVX

Asset Classes: 90%+ Equities

Industries: 20% Financials, 12% industrials, 11% Oil/Gas, 11% Consumer Services

Company Weightings: Equal Weightings to companies, and heavy exposure to financials industry

# Holdings: 165

% of top 10: 12.25%

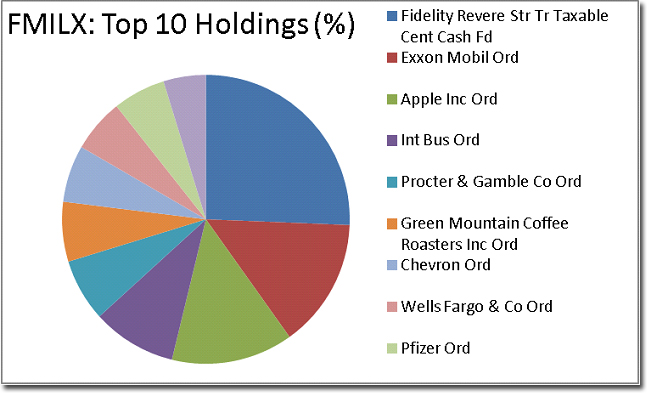

Fund: FMILX

Asset Classes: 90%+ Equities

Industries: 20% Technology, 14% Health Care, 13% Consumer Goods, 11% Financials

Company Weightings: Heavily weighted to top ten holdings and technology industry.

# Holdings: 206

% of top 10: 19%