In an effort to help personal investors better understand what kind of risks and opportunities they are exposed to within their portfolio, I’m going to start dedicating an entire post every week to understanding specific mutual funds.

In an effort to help personal investors better understand what kind of risks and opportunities they are exposed to within their portfolio, I’m going to start dedicating an entire post every week to understanding specific mutual funds.

In these posts, I’ll summarize all of the relevant information associated with a particular mutual fund, including any relevant expenses or risks that the average investor might not casually be aware of on their own.

Lastly, I’ll guide you through the mindset I used to evaluate the fund as an investment opportunity in itself. While this guide is only my opinion, and in no way quality investment advice that is specifically tailored to your situation, it provides a useful framework for evaluating similar funds on your own.

This week, I’ve dug through a list of high income funds to help you understand where there might lie a good opportunity to begin generating some reliable income returns. It didn’t take long for me to realize that BlackRock was the best place to start looking, as a blunt screen for quality and returns placed the BlackRock High-Income family of funds at every single one of the top spots in the search. For this specific article, I’m going to dig into the Inflation Protected Bond Fund (BPRAX). (http://www.blackrock.wallst.com/public/fund/profile.asp?symbol=BPRAX)

Objective & Strategy

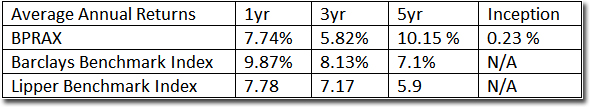

BPRAX’s objective is to maximize real returns, as opposed to focusing on nominal gains. This is achieved by investing at least 80% of its assets into inflation-indexed bonds that are laddered for cash flow over a number of terms. The fund’s returns are then benchmarked internally against the Barclays Capital Global Real: US TIPS Index (a fund similarly indexed to inflation), and the Lipper Treasury Inflation Protected Securities Funds category average.

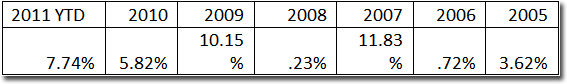

Comparative Performance & Benchmarking

While the fund has shown favourable returns over the short term, it has only managed to outperform the Lipper TIPS benchmark, while remaining generally competitive with the Barclays comparative fund.

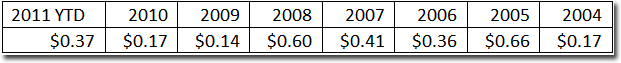

Distributions

Capital Gains

Capital Requirements and Fees

The fund requires $1,000 in initial investment, but each incremental purchase above that amount can be as little as $50. In addition, the fund charges a maximum front-end charge of 4%. This charge begins to decrease after investors purchase in increments greater than $25,000. Given that the fund’s year end date is on the 30th of September, investors might want to avoid purchasing units until after that day, so as to avoid any unexpected tax consequences or redemption price movements.

Risk Metrics

Statistically speaking, the fund’s NAV over a three year period has historically moved with a 7.76% standard deviation, which is .61% less than its benchmark rate. In addition, it maintains a beta of approximately .91 in comparison to its benchmark indexes, with a Sharpe Ratio of 1.00 compared to a benchmark of .95. What this means is that the fund itself shows a tendency to provide more efficient returns than its benchmark index, but with a smaller volatility. This creates leaves the impression of slightly more reliable returns.

Holdings

The fund breaks down its holdings as being over 90% exposed to Inflation-Indexed US Debt Securities. This means that the fund will provide predictable real returns in any inflationary environment. These securities have then been laddered in order to stagger payment days, to create diversified monthly cash flow for the unit holders. Approximately 25% of these holdings have been separately allocated towards short-medium term holdings, which is favourable in a ‘trough’ period of the economic cycle. The remaining capital has generally be allocated towards non-inflation-hedged US Treasury bills, and cash equivalents.

When reviewing this composition, it is important to note how the composition of the Barclays benchmark (which is barely out-performing this fund) holds a greater weighting of its assets in longer-term bonds. The time-value risk associated with these interest terms may be just enough to account for the discrepancies between the performances.