Baby Boomers are on the verge of exiting the labor force in very large numbers, despite the Great Recession wiping out those who were born between the years 1946 and 1964. However, they may not be financially equipped for their long-term care needs, especially considering that a majority are either obese or overweight.

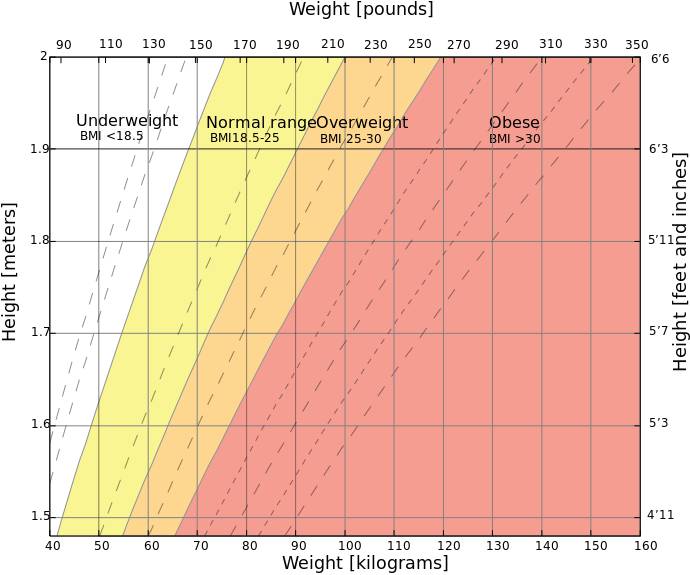

That is the finding of a new report published by the United States Census Bureau (PDF), which found that 72 percent of men and 67 percent of women that are 65 years of age and older are classified as being either overweight or obese. Obesity rates are continuing to rise, even though older adults are smoking and drinking less.

Excessive weight gain can lead to various health problems, such as diabetes, heart disease, arthritis and many others. This has many caused for concern because it’ll require long-term healthcare treatment for Baby Boomers, which also comes with a hefty price-tag.

Unfortunately for them, it would take more than just exercise and a balanced diet because a strategy would be different for them than the average young adult or middle-aged person. The problem is that there haven’t been too much research studies examining older people and the issue of obesity.

“Most of the long-term care provided to older people today comes from unpaid family members and friends,” said Richard Suzman, director of National Institute on Aging’s division of behavioral and social research, in a statement. “Baby boomers had far fewer children than their parents. Combined with higher divorce rates and disrupted family structures, this will result in fewer family members to provide long-term care in the future.”

The report highlighted the fact that individuals need to start taking care of their health early on so they can avoid these kinds of setbacks later on in life. Essentially, if healthcare costs want to be cut long-term than individuals need to start getting healthy right at this moment: plenty of exercise, a nutritious diet and cutting out vices (alcohol, smoking, drugs).

Indeed, it could spell danger for Baby Boomers, considering that a lot of them are on the brink of financial catastrophe. According to a study released at the beginning of the year, a growing number of aging boomers are less financially secure and maintain a lower standard of living than their parents. In fact, the media net worth of a U.S. household led by a person between 55 and 64 is eight percent lower than those 75 and older in the year 2011.

“Baby boomers are the first generation without the safety net of pensions and other benefits their parents have,” Alicia Munnell, director of the Center for Retirement Research at Boston College, told BusinessWeek. “They’re facing a much more challenging old age.”

A January Gallup poll discovered that a large number of Baby Boomers are reluctant to retire. According to the study, more than one-third (39 percent) expect to retire at 66 or older and 10 percent never expect to retire.